how to pay indiana state estimated taxes online

Take the renters deduction. You can set up a payment plan with the Indiana Department of Revenue by calling 317-232-2165 or visiting wwwintaxpayingov.

Indiana Income Tax Calculator Smartasset

To pay an estimated payment or an extension payment for your Corporation Income Tax andor Limited Liability Entity Tax LLET.

. All Michigan Individual Income Tax filers may choose to make a payment using a debit or credit card. Pay my tax bill in installments. In 2017 this rate fell to 323 and remains there through the 2021 tax year.

Find Indiana tax forms. How do I pay my Indiana state taxes. Realty Transfer Tax Payment.

Tom Wolf Governor C. Make a payment online with INTIME by credit card or electronic check. The tax bill is a penalty for not making proper estimated tax payments.

If the amount on line I also includes estimated county tax enter the portion on lines 2 andor 3 at the top of the form. Set up a payment plan if you owe more than 100 using INTIME. The statewide sales tax is 7 and the average effective property tax rate is 081.

Have more time to file my taxes and I think I will owe the Department. For additional information refer to Publication 505 Tax Withholding and Estimated Tax. Estimated Indiana income tax due enter the amount from line I on line 1 State Tax Due at the top of the form.

Debit card payments will be charged a flat fee of 395. Only break out your spouses estimated county tax if your spouse owes tax to a county other than yours. SBAgovs Business Licenses and Permits Search Tool allows you to get a listing of federal state and local permits licenses and registrations youll need to run a business.

Make a payment in-person at one of DORs district offices or downtown Indianapolis location using cash exact change only credit card money order or check. Page Last Reviewed or Updated. File my taxes as an Indiana resident while I am in the military but my spouse is not an Indiana resident.

Enter your financial details to calculate your taxes. However many counties charge an additional income tax. Estimated Indiana income tax due enter the amount from line I on line 1 State Tax Due at the top of the form.

Visit IRSgovpayments to view all the options. Estimated payments may also be made online through Indianas INTIME website. Personal Income Tax Payment.

We last updated the Estimated Tax Payment Voucher in January 2022 so this is the latest. Claim a gambling loss on my Indiana return. Tax Payment Solution TPS - Register for EFT payments and pay EFT Debits online.

If filing a paper return with payment make the check or money order payable to Kentucky State Treasurer and mail to. If you owe 1000 or more in state and county tax thats not covered by withholding taxes or if not enough tax was withheld you need to be making estimated tax payments. Department of Administration - Procurement Division.

Know when I will receive my tax refund. You may send estimated tax payments with Form 1040-ES by mail or you can pay online by phone or from your mobile device using the IRS2Go app. The fee will appear as a separate transaction on your bank or card statement and is paid.

Depending on the amount of tax you owe you might have up to 36 months to pay off your tax debt. If you did make estimated tax payments either they were not paid on time or you did not pay enough to. Only break out your spouses estimated county tax if your spouse owes tax to a county other than yours.

Indiana Small Business Development Center. Cookies are required to use this site. This portal also lets you track refunds request individual extensions reinstate corporations and request corporate dissolutions and other services.

If the amount on line I also includes estimated county tax enter the portion on lines 2 andor 3 at the top of the form. Your browser appears to have cookies disabled. Youll have to register to create an INTIME Indiana tax payment login and once you set everything up you can make payments online and manage scheduled payments.

Credit card payments will be assessed a convenience fee of 235 of the total payment amount. Use form ES-40 to pay Indiana state estimated quarterly taxes if applicable.

Indiana Income Tax Calculator Smartasset

Free Online Paycheck Calculator Calculate Take Home Pay 2022

Estimated Tax Payments For Independent Contractors A Complete Guide

What Is Local Income Tax Types States With Local Income Tax More

Prepare Efile Your Indiana State Tax Return For 2021 In 2022

Tax Year 2022 Calculator Estimate Your Refund And Taxes

Taxact 2020 State 1040 Edition State Federal Tax Filing

Dor Owe State Taxes Here Are Your Payment Options

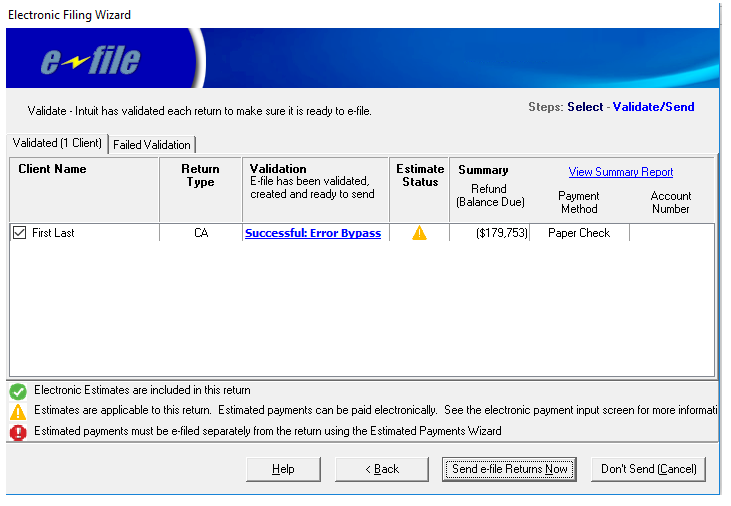

Using The E File Estimated Payment Wizard In Lacerte

![]()

Dor 2021 Individual Income Tax Forms

What Is Local Income Tax Types States With Local Income Tax More

Dor Owe State Taxes Here Are Your Payment Options

How Can I Cancel A Pending Tax Payment

![]()

Dor 2021 Individual Income Tax Forms

How To Pay Quarterly Taxes Online Much Easier Once You Know How Irs Estimated Taxes Direct Pay Youtube