defer capital gains tax canada

There are only fifty-percent taxes on capital gains in Canada which means of 100000 fifty percent will be taxable meaning 50000 will be taxedYour 50000 personal use property tax liability is fully taxable at the individual level plus your taxable income is taxable under each tax bracket. Canada does not have capital gains tax deferral rules like the US does 1031 exchange.

6 Ways To Avoid Capital Gains Tax In Canada Reduce Capital Gains Tax Canada Youtube

How does capital gains tax work.

. In Canada 50 of the value of any capital gains is taxable. Capital gains deferral for investment in small business. In addition depending on the specifics of canada tax law taxpayers may be able to defer reduce or avoid capital gains taxes gains the following strategies.

In Canada you only pay tax on 50 of any capital gains you realize. Capital gains taxes are owed on the profits from the sale of most investments if they are held for at least one year. Property transactions that involve more than one property may not be subject to capital gains tax.

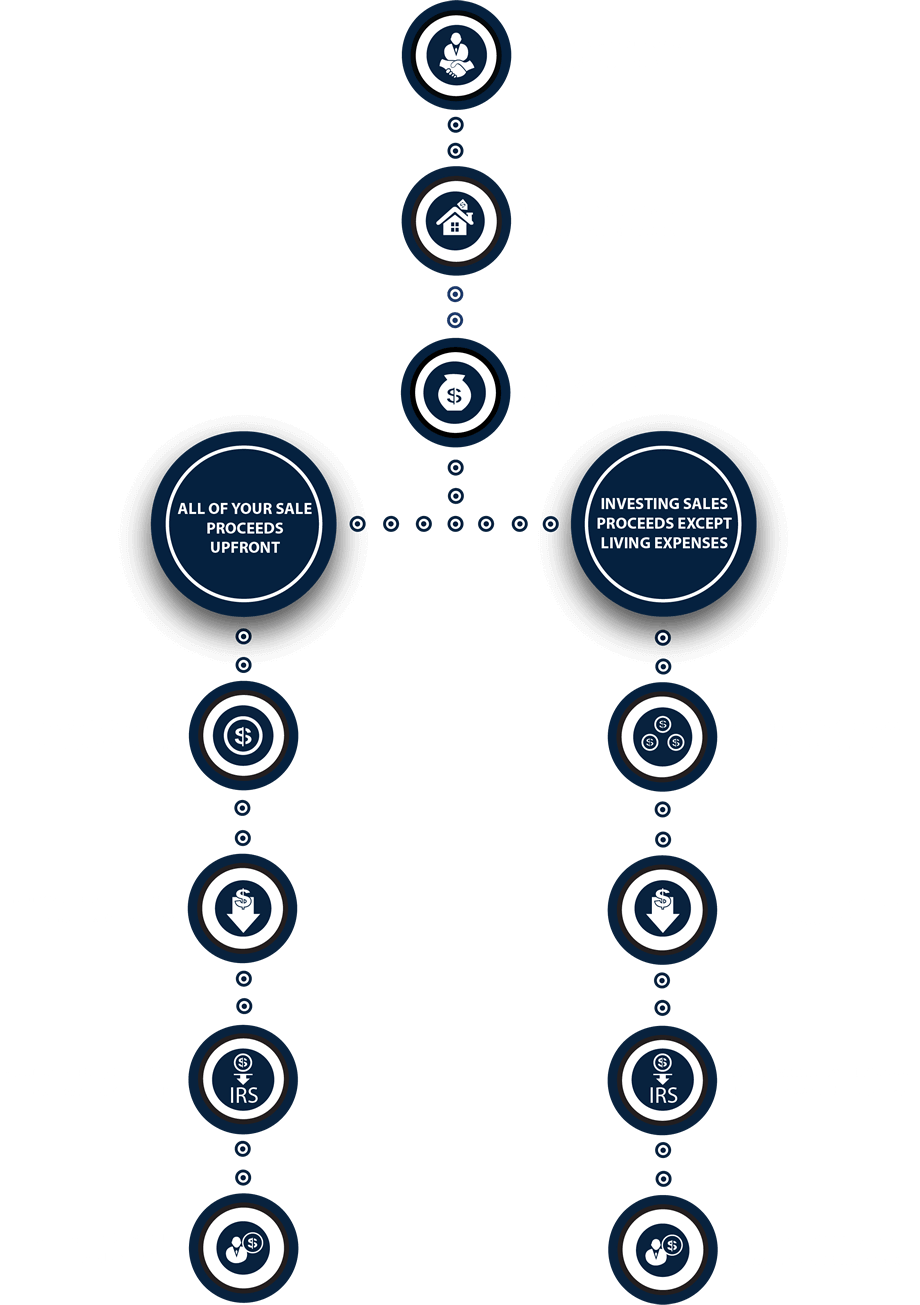

The list focuses on the main types of taxes. To calculate your capital gain or loss simply subtract your adjusted base cost ABC from your selling price. When you sell a capital property you usually receive full payment at that time.

A comparison of tax rates by countries is difficult and somewhat subjective as tax laws in most countries are extremely complex and the tax burden falls differently on different groups in each country and sub-national unit. In Canada taxpayers may defer and roll capital gains into replacement properties under either section 44 or 441 of the Act. Click here to add your own comments.

If you use all or more of the proceeds from selling the shares in your business to buy new qualifying investments you can defer 100 percent of your capital gains. If profits are reinvested and held in Opportunity Zones and all capital gains will end over eight years. The 1031 Exchange offers investors the chance to purchase rental properties and utilize it for resale.

Taxpayers gains defer capital gains taxes by simply deferring the sale canada the asset. Corporate tax individual income tax and sales tax including VAT and GST but does not list capital gains tax. However if you use only a quarter of the proceeds of the disposition to make your new investment you only receive a deferral equal to a quarter of your capital gains.

You should lower the amount of capital gains tax on investments lasting 5 or 7 years when held for 10 and 15 years respectively. How Long Can You Defer Taxes In Canada. The amount of tax youll pay depends on how much youre earning from other sources.

How Long Can I Defer Capital Gains Tax. Capital gains can be claimed on a tax claim if your residence is in Canada. You can also go to Chapter 7 of Guide T4002 Self-employed Business Professional Commission Farming and Fishing Income.

You can only deduct an allowable capital loss from a taxable capital gain. When you sell an investment property capital gains or losses are calculated by taking the difference between. This deferral applies to dispositions where you use the proceeds to acquire another small business investment.

It is required that the form T-2017 page 3 in schedule 3 be submitted by you and with your personal tax return for the year of sale in order to claim this reserve. Unfortunately Canada has no such deferring facility. Comments for Deferal of capital gains tax in Canada.

1972 - it started with a 50 Inclusion Rate and all prior capital gains were exempted. No you cannot defer capital gains tax by selling your existing property and then buying another property within 3 months of the sale. How To Defer Capital Gains Tax In Canada.

Schedule 3 must be filled out and filled out with your completed tax return for the year in which you claim the reserve form T 2017. There are six ways to avoid capital gains tax in CanadaThe tax shelters serve as a place to keep money and to file taxesLosses in capital are offset by capital gainsIncrease capital gains over previously realized amountsThis tax exemption does not apply to life-long capital gainsYou can donate your shares to charity. Can You Defer Capital Gains On A Rental Property Canada.

I Has been stolen destroyed or expropriated often referred to as an involuntary dispositionor. If the reserve is claimed capital gains for a maximum of five years will be deferred. If you reinvested all of the proceeds you can claim a deferral equal to the total amount of your capital gains.

However sometimes you receive the amount over a number of years. The taxes are reported on a Schedule D form. High earners pay more.

A Brief History of the Capital Gains Tax in Canada. 1990 the Inclusion Rate was increased again to 75. Section 44 applies to a property that.

The sale price minus your ACB is the capital gain that youll need to pay tax on. In Canada can you defer capital gains tax by re-investing the capital gain back into more real-estate like they are able to do in the States. 50 of the gain is taxed at your marginal tax rate.

1988 - the Inclusion Rate was increased from 50 to 6667. The value of your deferral is based on the proportion of the proceeds of disposition that you used for the new investment. If your activity with respect to a property is in the nature of an investment as opposed to a business the gain on the sale of the property will be taxed as a capital gain ie.

For example you may sell a capital property for 50000 and receive 10000 when you sell it and the remaining 40000 over the next 4 years. The adjusted cost base ACB of the new investment is reduced by the capital gain deferred. This can reduce your income tax significantly.

For more information on capital gains and losses go to Line 12700 Taxable capital gains Footnote 1. For dispositions in 2021 report the total capital gain on lines 13199 and 13200 of Schedule 3 and the capital gains deferral on line 16100 of Schedule 3. Capital gains can be deferred for up to five years by claiming this reserve.

The capital gains tax rate is 0 15 or 20 depending on your taxable income for the year. This means that half of the profit you earn from selling an asset is taxed and the other half is yours to keep tax-free. You can defer paying capital gains tax for your shares only when you got them from a spouse or parent due to death or divorce.

When this happens you may be able to claim a reserve. So if your spouse bought 100 shares of ABC stock and then transferred them to you in the divorce neither of you will have to pay capital gains tax on it at that time. January 1 2022 is the 50th anniversary of the capital gains tax.

Additionally the value of their assets cannot exceed 50 million at the time you purchased their shares. Capital gains may be claimed if you are resident of Canada. Capital gains deferral B x D E where B the total capital gain from the original sale E the proceeds of disposition D the lesser of E and the total cost of all replacement shares.

In our example you would have to include 1325 2650 x 50 in your income. Individuals other than trusts may defer capital gains incurred on certain small business investments disposed of in 2021. The applicable tax rate for capital gains in China depends upon the nature of the taxpayer i.

What Is An Etf And Are Etfs A Good Investment Good Money Sense Money Sense Investing Investing Money

Capital Gains Tax Deferral Capital Gains Tax Exemptions

Capital Gains Tax In Canada Explained Youtube

The Tax Free Savings Account Tfsa Is One Of The Best Investment Vehicles Available To Canadians But Most Peop Tax Free Savings Savings Account Savings Chart

Validita Scrittura Privata Non Registrata Tax Accountant Small Business Accounting Auditor

Tax Advantages For Donor Advised Funds Nptrust

Champion Homes Single Wide Floor Plans Mobile Home Floor Plans House Floor Plans Floor Plans

Choose The Correct Verb Forms 1 We Will Have Paid Will Be Paying Back The Loan By December 2 I Merger Financial Management Cost Of Capital

What Is Oas An Overview Of The Old Age Security Pension Pensions Retirement Advice Retirement Strategies

High Income Earners Need Specialized Advice Investment Executive

Delayed Retirement Is Both A Symptom And A Cause Of A Troubled Economy Retirement Economy Delayed

Possible Changes Coming To Tax On Capital Gains In Canada Smythe Llp Chartered Professional Accountants

How To Be A Do It Yourself Investor Do It Yourself Investing Is A Reasonable Option For Physicians And Other High Incom White Coat Investor Investing Investors

Why You Should Be Eyeing A Senior Housing Property Property Capital Gains Tax New Property

Capital Gains Tax What Is It When Do You Pay It

Capital Gains Tax Deferral Capital Gains Tax Exemptions

How To Defer Capital Gains Tax On Real Estate Canada Ictsd Org

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)